Vietnam’s solar cell manufacturing market is witnessing a significant transformation, largely driven by foreign investments. With a growing demand for renewable energy solutions, Vietnam is positioning itself as a key player in the solar energy sector in Southeast Asia. This article examines the situation of the solar cell manufacturing market and recent investment activities, particularly focusing on Japan-invested companies.

The Rise of Solar Energy in Vietnam

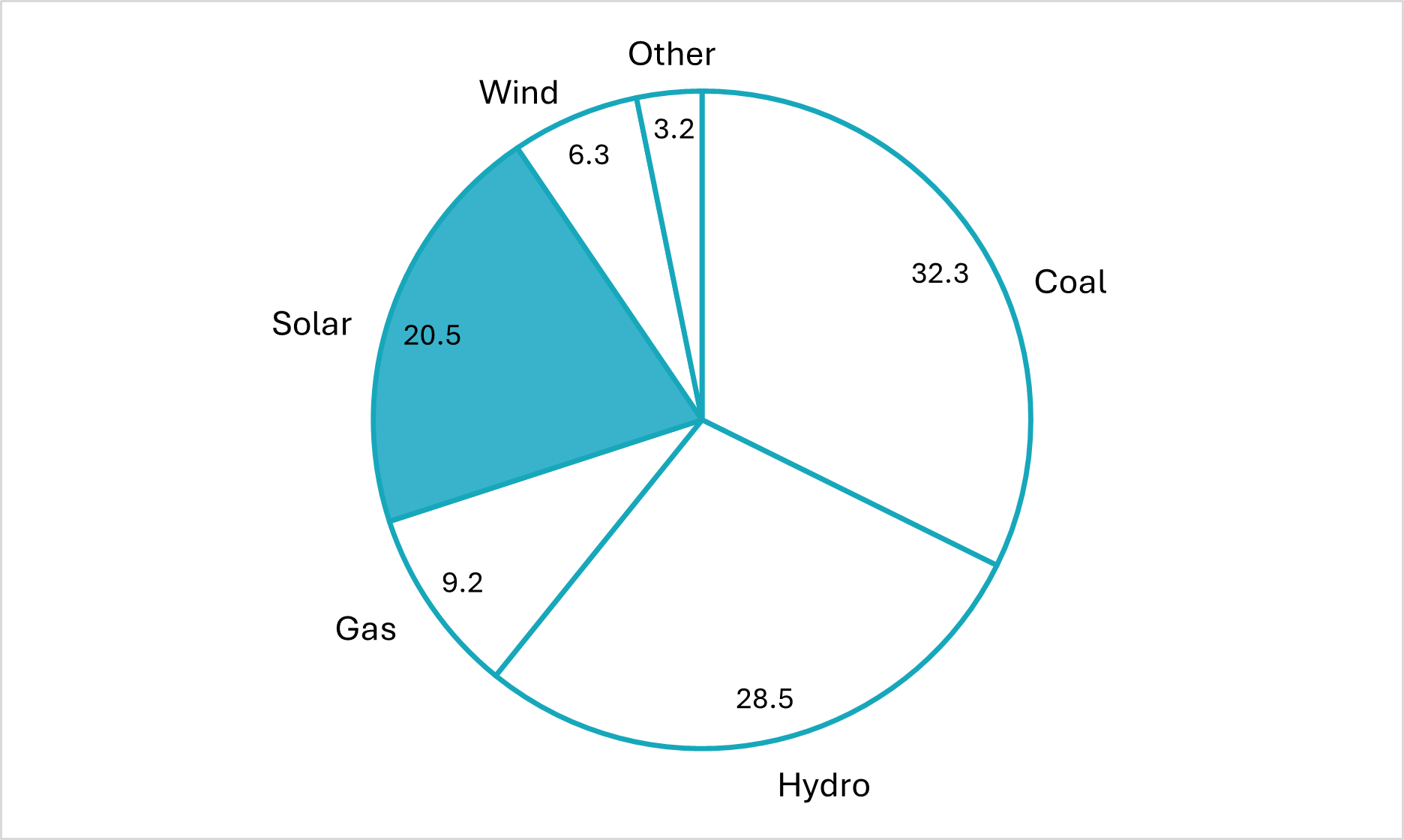

Vietnam is undergoing a significant transition towards renewable energy as it moves away from fossil fuels dependency. Under the Power Development Plan VIII (PDP8), the country aims to reduce its reliance on fossil fuels while dramatically increasing the share of renewable energy in its power generation mix. In 2023, the total capacity of renewable energy sources in Vietnam was about 22 GW (accounting for 27%) of the total power source capacity [1]. Of which, wind power is 5 GW [2], solar power is 16.5 GW, biomass power is 0.4 GW [3]. By 2030, Vietnam targets renewables to account for over 50% of its total power capacity, with further expansion planned to reach nearly 70% by 2050 [4]. This shift is essential for meeting the nation’s commitment to achieving net-zero carbon emissions by mid-century. Among the various renewable sources, solar power has emerged as a key driver of this transformation.

Vietnam’s power sources by types in 2023

100%= 80.7 gigawatt

Source: vneconomy

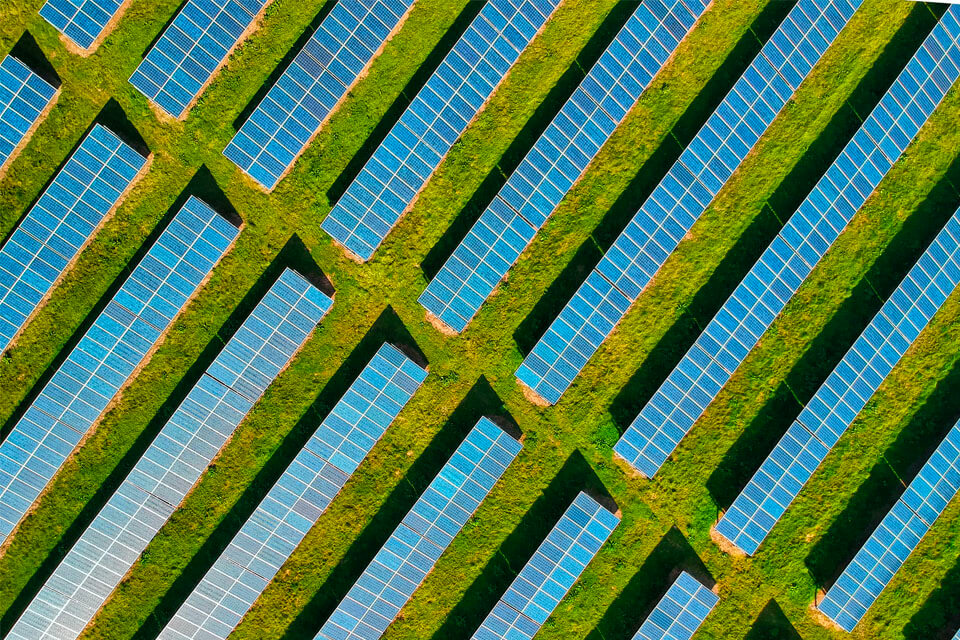

Vietnam’s solar energy sector has experienced exponential growth in recent years, positioning the country as a major player in the global renewable energy landscape. In 2018, solar power generation was almost negligible, but government incentives such as feed-in tariffs and tax benefits spurred rapid investment. By the end of 2023, the total solar power capacity in Vietnam will reach about 16.6 GW, of which rooftop solar power accounts for more than 9 GW, contributing about 20.5% to the country’s total electricity. [5]. Looking ahead, PDP8 outlines plans to increase solar capacity to 34 GW by 2030, with projections reaching 189 GW by 2050. These ambitious targets highlight the immense growth potential of Vietnam’s solar power industry and, by extension, the solar cell manufacturing market.

As demand for solar energy continues to rise, Vietnam is also seeing increased solar panel production and installation. The country’s strategic location, abundant sunlight, and strong government backing make it an attractive destination for solar manufacturing investments. With expanding domestic and international demand, Vietnam has the opportunity to become a regional hub for solar panel and solar cell production, further reinforcing its role in the global renewable energy transition.

Main players in Vietnam’s solar cell manufacturing market

| Company Name | Country of origin | Main business activities | Factory Location |

| Trina Solar | China | · Manufacturing photovoltaic (PV) products, including wafers, solar cells, and modules. | Bac Giang Province

Thai Nguyen Province |

| JA Solar | China | · Production of solar cells, modules, and other PV products. | Bac Giang Provine

|

| Vinasolar | China | · Production of solar modules and photovoltaic cells. | Bac Giang Provine |

| First Solar | USA | · Manufacturing thin-film solar modules. | Ho Chi Minh city |

| Canadian Solar | Canada | · Manufacturing solar photovoltaic modules and provision of battery energy storage solutions. | Hai Phong City |

In general, China currently dominates Vietnam’s solar cell manufacturing market. These companies have positioned Vietnam as a key manufacturing hub, benefiting from the country’s favorable investment policies and growing demand for renewable energy.

Most solar cell factories in Vietnam are concentrated in the northern part of Vietnam particularly Bac Giang Province, where companies like Trina Solar, JA Solar, Vina Solar operate large-scale production facilities.

The primary products manufactured in Vietnam’s solar sector include photovoltaic modules, monocrystalline and polycrystalline silicon bars, solar wafers, and thin-film solar cells. With increasing global demand for solar energy solutions, Vietnam’s solar manufacturing industry is poised for further growth, reinforcing its role as a crucial supplier in the international renewable energy market.

Japanese Investment in Solar Cell Manufacturing

Japan has been one of Vietnam’s largest foreign direct investors for many years, but its presence in the country’s solar cell manufacturing industry has been relatively limited. While Japanese enterprises have been active in Vietnam’s broader renewable energy sector, their direct involvement in solar cell production remained minimal. However, in recent years, Japan has been steadily increasing its influence in this industry, leveraging its advanced technology and strong capital investment to expand its footprint.

A key recent investment is Vsun Solar, a subsidiary of Japan’s Fuji Solar, which has been expanding its presence in Vietnam. In November 2023, the company inaugurated the first phase of its $200 million solar cell factory in Phu Tho province, with an annual capacity of 4 GW. The second phase is expected to be completed in 2024, further enhancing Vietnam’s production capabilities. Additionally, in April 2024, Vsun Solar started producing its first silicon wafer at its Vietnam facility, completing an integrated production chain for solar panel manufacturing.[6]

Another major player is Sunergy, a Japanese-backed company, which is developing a $30 million solar cell manufacturing plant in Hung Yen province. Spanning 2.65 hectares in Minh Quang Industrial Park, the facility will have an annual capacity of 600 million silicon wafers, a critical component in solar cells. Set to begin operations in June 2025, it is expected to create around 1,000 jobs, further integrating Japan into Vietnam’s solar value chain.[7]

VSUN’s Factory in Vietnam

Source: theinvestor.vn

With these investments, Japanese enterprises are strengthening their foothold in Vietnam’s solar cell manufacturing market. As the demand for solar energy grows, Japan’s expertise and capital are likely to drive further expansion, positioning Vietnam as a key player in the global solar supply chain.

Challenges and Opportunities in The Solar Cell Manufacturing Market

Vietnam’s commitment to expanding its solar energy sector presents significant opportunities for the growth of its solar panel manufacturing market. The country has set ambitious renewable energy targets under its national energy development plans, encouraging both domestic and foreign investment in solar power projects. Government incentives, such as feed-in tariffs and tax benefits, have further stimulated the market, making Vietnam an attractive destination for solar panel production. Additionally, Vietnam’s geographic location and high solar radiation levels provide an ideal environment for large-scale solar energy adoption, ensuring a steady demand for locally manufactured solar components

However, despite these promising opportunities, challenges remain. The competition in Vietnam’s solar manufacturing market is intensifying, particularly with the strong presence of Chinese enterprises, which dominate global solar panel production. These firms bring economies of scale and cost advantages, making it difficult for other manufacturers to compete in price. Additionally, the supply chain for raw materials and components remains vulnerable to fluctuations in global markets, creating potential risks for production stability.

结论

Vietnam’s solar cell manufacturing market is poised for significant growth, fueled by substantial investments from Japanese enterprises. The entry of companies like Vietnam Sunergy marks a pivotal step in establishing Vietnam as a competitive player in the global solar industry. With supportive government policies, technological advancements, and a favorable investment climate, Vietnam is well-positioned to capitalize on the growing demand for renewable energy solutions.

As the market evolves, stakeholders must address challenges such as competition, supply chain vulnerabilities, and regulatory complexities. However, the opportunities presented by the global transition to renewable energy far outweigh these challenges. With continued investment and innovation, Vietnam can emerge as a leader in the solar energy sector, contributing to a more sustainable future both domestically and globally.

[1] https://www.evn.com.vn/d6/news/Mot-so-so-lieu-tong-quan-ve-nguon-dien-toan-quoc-nam-2023-66-142-124707.aspx

[2] https://vneconomy.vn/go-diem-nghen-phat-trien-dien-mat-troi-mai-nha.htm

[3] https://vneconomy.vn/dien-sinh-khoi-kho-phat-trien-do-thieu-chinh-sach-hap-dan.htm

[4] https://theinvestor.vn/vietnam-plans-to-generate-50-of-power-from-renewable-sources-by-2030-d4967.html

[5] https://vneconomy.vn/go-diem-nghen-phat-trien-dien-mat-troi-mai-nha.htm

[6] https://vir.com.vn/japans-vsun-solar-starts-silicon-wafer-production-in-vietnam-110670.html

[7] https://theinvestor.vn/japan-invested-solar-cell-maker-vietnam-sunergy-to-start-30-mln-plant-from-june-d14381.html

| B&Company有限公司

自 2008 年以来,第一家专门在越南从事市场研究的日本公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |