Vietnam’s e-commerce market experienced remarkable growth in 2024, solidifying its position as one of Southeast Asia’s digital powerhouses. Driven by increasing smartphone penetration, a tech-savvy young population, and supportive government policies. As 2025 approaches and the future ahead, Vietnam’s e-commerce landscape is poised for transformation, sustainability efforts, and cross-border trade opportunities.

Vietnam E-Commerce Market in 2024

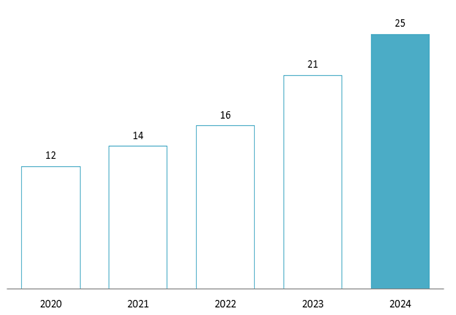

Vietnam’s e-commerce market is estimated to surpass USD 25 billion in 2024, marking a 20% increase compared to 2023. E-commerce in Vietnam accounts for two-thirds of the total value of the country’s digital economy and 9% of the total retail goods and consumer service revenue nationwide[1]. Within the Southeast Asian region, Vietnam’s e-commerce market ranks 3rd in size, following Indonesia and Thailand

Vietnam’s e-commerce market value from 2020 to 2024

Unit: Billion USD

Source: Ministry of Industry and Trade

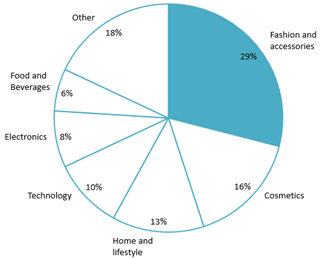

In addition, Vietnam’s e-commerce platforms have seen significant growth, particularly TikTok Shop and Shopee, with revenue in 2024 increasing by 151% and 66%, respectively. By June 2024 alone, the total revenue from all e-commerce platforms in Vietnam reached 3 billion USD. Among product categories, fashion and accessories led the market, generating nearly 1 billion USD. Other top-performing categories included cosmetics, home and lifestyle products, technology, and household appliances.

Revenue of e-commerce platform in Vietnam by segment by June 2024

来源: AccessTrade

The rapid growth of e-commerce has also paved the way for favorable export growth through online platforms. Vietnam’s B2C e-commerce export value is projected to reach nearly 6 billion USD by 2028, with Micro, Small, and Medium-sized Enterprises (MSMEs) contributing 25% to this growth[2]. Key export destinations for MSMEs include major markets such as China, the USA, and Japan, as well as emerging opportunities in England, Europe, and East Asia[3].

Opportunities and Challenges for Market Growth

By 2024, Vietnam has approximately 79 million internet users, accounting for 79% of the country’s population[4]. Coupled with nearly 100% mobile connectivity, e-commerce has been able to expand widely, reaching both urban and rural areas[5]. In the same year, the online payment market reached USD 149 billion, an 18% increase from the previous year, and is projected to hit USD 350 billion by 2030[6]. The rise of digital payment platforms has facilitated smoother transactions, making it easier for customers to shop online. This shift toward cashless payments is integral to e-commerce growth, providing secure and efficient options for consumers. In a recent Q&Me survey of 300 respondents, 81% reported making purchases at least once a month, while the remaining 19% shopped less frequently, about once a month or less.

Despite progress in urban areas, delivering goods to remote and rural regions remains a challenge due to underdeveloped infrastructure. This limitation impacts delivery times and raises operational costs, hindering e-commerce expansion into these areas[7]. Additionally, counterfeit and low-quality goods remain a prevalent issue on major e-commerce platforms such as Shopee and TikTok Shop. Many sellers openly market counterfeit products from well-known brands like Rolex, Adidas, Nike, Cerave, etc. This has heightened consumer concerns about product authenticity, leading some customers to prefer purchasing directly from trusted physical stores[8].

Another critical challenge is the shortage of high-quality human resources in Vietnam. According to an AccessTrade survey of 200 MSMEs, 95% of respondents reported facing difficulties due to a lack of skilled labor. Key roles identified as most in demand include e-commerce software developers (67%), digital marketing specialists (63%), supply chain and logistics experts (62%), and multilingual customer service representatives (49%). These gaps significantly impact the ability of businesses to meet operational demands and sustain growth in the e-commerce sector[9].

The prospect of Vietnam E-Commerce Market in the Future

Vietnam continues to maintain steady e-commerce growth with a projected CAGR of 18–20% in the coming years. By 2030, the market is expected to reach a revenue of USD 63 billion. Vietnam’s strategic location and its participation in trade agreements such as the CPTPP, EVFTA, and RCEP position it as a hub for cross-border e-commerce, further enhancing export opportunities. The integration of social commerce platforms like TikTok Shop and Shopee is reshaping how businesses engage with younger, tech-savvy demographics. Combined with the government’s draft of the National Master Plan for E-Commerce Development for the period 2026 to 2030, expected to be released in 2025, which outlines goals and responsibilities for ministries and agencies, Vietnam aims to establish itself as a leading e-commerce center in Southeast Asia.

– E-commerce retail sales are expected to grow by 20–30% annually, accounting for 20% of the total national retail sales of goods.

– The proportion of businesses adopting e-commerce is targeted to exceed 70%.

– 60% of higher education and vocational training institutions are set to implement specialized training programs in e-commerce-related fields.

The e-commerce market is expected to thrive even further in the future with the participation of various international e-commerce platforms. Specifically, in 2024, Vietnam welcomed the entry of two major platforms, Temu and Shein, from China. However, these two e-commerce giants were required to halt operations shortly after due to the need to complete necessary procedures[10]. Nonetheless, this situation highlights the potential of Vietnam’s e-commerce market, as many prominent players are either ready to enter or planning to tap into this highly attractive market.

结论

Vietnam’s e-commerce market is a key driver of Southeast Asia’s digital economy, with strong growth fueled by rising internet access, and supportive government policies. While challenges like infrastructure and consumer trust remain, cross-border trade still presents immense opportunities. By addressing these hurdles, Vietnam is on track to solidify its position as a regional leader in e-commerce, offering a promising future for businesses and consumers.

[1] Ministry of Industry and Trade Web Portal (2025). E-commerce Accounts for Two-thirds of Vietnam’s Digital Economy. <使用权>

[2] The Vietnam Plus Newspaper (2024). Vietnam E-commerce Boom in 2024 <使用权>

[3] Access Partnership (2024). The E-commerce Revolution in Vietnam <使用权>

[4] Datareportal (2024). Vietnam’s Digital in 2024 <使用权>

[5] Lao Dong Newspaper (2024). Vietnam’s Mobile Connectivity Rate Reached Nearly 100% <使用权>

[6] Google E-conomy SEA (2024). Vietnam’s E-conomy Report <使用权>

[7] Savills Vietnam (2024). Ecommerce in Vietnam: Rapid Growth and Market Expansion <使用权>

[8] Dai Bieu Nhan Dan Newspaper (2023). Counterfeit Products on E-commerce Platforms <使用权>

[9] Access Partnership (2024). The E-commerce Revolution in Vietnam <使用权>

[10] Reuters (2024). Temu and Shein Suspend Vietnam Operations <使用权>

| B&Company有限公司

自 2008 年以来,第一家专门在越南从事市场研究的日本公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |

阅读其他文章