Education plays a pivotal role in Vietnam’s socio-economic development, fostering innovation and preparing the workforce for the rising demand for high-skilled labor. As the nation moves toward its 2030 development goals, the education sector presents a wealth of opportunities for foreign investors, especially through M&A transactions.

Overview of Vietnam’s education system

Vietnam’s education system consists of formal education and continuing education, which is structured into multiple levels, designed to provide a comprehensive and inclusive educational pathway for its citizens[1], including:

– Preschool education includes junior kindergartens and senior kindergartens;

– General education consists of primary education, lower secondary, and upper secondary education, with primary education being the compulsory education stipulated under Vietnam’s Education Law;

– Vocational education offers training at the elementary level, intermediate level, or college level, as well as other vocational training programmes; and

– Higher education includes university education, master education, and doctoral education.

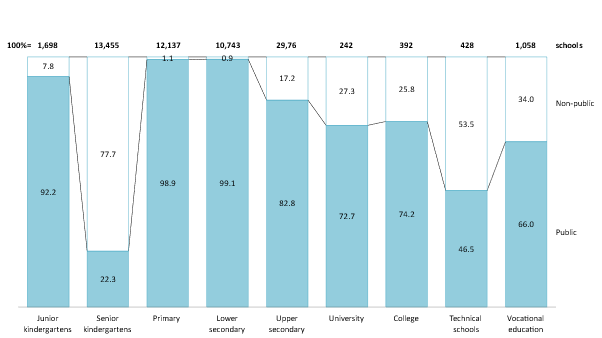

Over recent decades, Vietnam has made impressive strides in improving access to education and educational quality. The country has a near-universal primary education completion rate of over 98% with all provinces offering adequate education standards[2]. In the school year 2023-2024, there were 522 thousand classes in general education, including 280 thousand primary classes; 168 thousand lower secondary classes, and 74 thousand upper secondary classes[3]. The number of classes rose by 1% to accommodate growing enrollments, despite the steady decline in schools from 28,951 in 2015[4] to 25,783 in 2024 due to mergers or closures into multi-level[5]. The state management of vocational education has been innovated towards enhancing decentralization, strengthening autonomy and governance for institutions, and increasing the accountability of the heads of these institutions[6]. 2024 also saw remarkable progress in Vietnam’s university education as the training quality of 11 university-level institutions is recognized globally[7].

Education establishments in Vietnam in the school year 2024-2025 (Unit: %)

원천: GSO, MOE, B&Company synthesis

The situation of foreign direct investment in education sector in Vietnam

Education, while not the largest sector for FDI, is gaining traction as a promising field for international investors[8]. As of 2023, the sector attracted a total of 695 foreign-invested projects with a total value of 4.6 billion USD[9]. In 2023, Vietnam registered 68 investment projects in education, increasing from 41 projects in the previous year and accounting for 2% of Vietnam’s total FDI projects[10].

Table 1: Registered FDI projects in Vietnam’s education sector, from 2019 to 2023

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Total number of registered FDI projects

(Unit: projects) |

4,028 | 2,610 | 1,818 | 2,169 | 3,314 |

| Total value of registered FDI projects

(Unit: million USD) |

38,952 | 31,045 | 38,854 | 29,288 | 39,390 |

| Number of registered FDI projects in education

(Unit: projects) |

72 | 57 | 27 | 41 | 68 |

| Value of registered FDI projects in education

(Unit: million USD) |

67 | 109 | 52 | 254 | 48 |

원천: GSO

Merger & Acquisition (M&A) is a popular method for investors to enter the education market as they can leverage existing knowledge and infrastructures while improving on financial capabilities and management expertise[11]. In 2023, US-based firm KKR invested 120 million USD in Vietnamese educational services provider EQuest Education Group whose offerings range from traditional general education to other vocational training and abroad education programs[12]. Taylor’s Education Group, which also backed by KKR, was reported to consider the acquisition of Koala House, a Vietnamese preschool education provider in 2024[13]. More recently, Nutifood made a strategic investment decision into Anne Hill International School to expand into the educational sector, particularly in formal education and language centers[14]. M&A is also used by domestic educational providers, such as the acquisition of IELTS Workshop, a popular IELTS test preparation center, by Vietnamese edtech startup Vuihoc[15].

EQuest’s Canadian International School received 120 million USD from KKR

원천: Investment News

The M&A landscape of Vietnam’s education sector is booming and active at all levels due to the government’s general encouragement. Firstly, Vietnam does not introduce any limit on the proportion of foreign-invested capital for educational institutions. Resolution No. 35/NQ-CP signed in 2019 also highlighted the government’s efforts to enable FDI in the sector by easing visa and work permit processes to attract foreign intellectuals, businesspeople, and enterprises[16]. Furthermore, Decree No. 86/2018/ND-CP allows foreign investors to provide services at all educational levels[17], and its amendments under Decree No. 124/2024/ND-CP signed in 2024 also introduce a phased investment timeline to reduce burdens for newly established institutions[18].

Vietnam’s education development targets for 2030

To align with its socio-economic development goals, Vietnam has set forth an ambitious Education Development Strategy to 2030, with a vision toward 2045 under Decision No. 1705/QD-TTg signed in December 2024. The strategy sets goals to improve the accessibility of education for all levels, as well as shifting the training programs to meet with the national demand in the workforce. In light of the growing number of school enrollments and the need for better education, the government also encourages the development of the private education sector of all levels.

Table 2: Development targets under Education Development Strategy to 2030, with a vision toward 2045 in Decision No. 1705/QD-TTg in 2024

| No. | Education sector | Development target |

| 1 | Preschool education | – Increasing enrollment rate in preschool education;

– 100% of preschool teachers meeting the required qualification standards; – 30% of preschools to be non-public, with 35% of children enrolled in non-public preschool educational institutions; – 100% of classrooms to be permanent and over 65% of preschools meeting national standards. |

| 2 | General education | – Maintaining the achievements in universal primary and lower secondary education;

– Increasing the percentage of students attending school at the correct age; – Increasing transition rate and completion rate; – 100% of classrooms to be permanent and over 65% of preschools meeting national standards; – 5% of the general education institutions are non-public, with 5.5% of children enrolled in non-public general education institutions. |

| 3 | Higher Education | – Number of university students per 10,000 people reaching at least 260;

– Percentage of university students within the 18–22 age group reaching at least 33%; – International students enrolled in higher education programs in Vietnam reaching 1.5%; – At least 40% of university lecturers hold doctoral degrees; – Proportion of students in STEM fields reaching 35%; – Average number of scientific publications and applied science and technology projects per full-time lecturer reaching 0.6 projects/year. |

| 4 | Vocational education | – Literacy rate for level-1 literacy among people aged 15–60 reaching 99.15%, and 98.85% for areas with special difficulties and ethnic minority regions;

– 90% of provinces achieving level-2 standards for literacy eradication; – 10 administrative units to join UNESCO’s Global Network of Learning Cities by 2030. |

| 5 | International cooperation in education | – Aligning Vietnam’s National Qualifications Framework with those of other nations and regions, engaging in mechanisms for the mutual recognition of international and regional degrees and credits;

– Participating in international quality assessments and rankings for general education and reputable global university rankings; – Fostering international cooperation and investment in establishing high-quality preschools, general education schools, and universities; – Attracting prestigious foreign universities to establish branch campuses in Vietnam; – Developing breakthrough mechanisms and policies to attract and utilize foreign experts, scientists, and overseas Vietnamese for teaching, research, and employment at Vietnamese universities; – Strengthening efforts to attract international students to study in Vietnam. |

원천: TVPL

Opportunities and challenges

Vietnam’s education sector presents numerous opportunities for foreign investors, driven by policy support, market demand, and evolving socio-economic conditions. The education sector of Vietnam is highly attractive due to a high awareness of education and a growing middle class that is willing to invest in quality education[19]. Investors in the education sector may benefit from various tax incentives, including corporate income tax reductions and exemptions, which enhance the attractiveness of investing in Vietnam’s educational landscape[20]. Lastly, there is a rising demand for specialized education services, especially STEM education to meet with the economic demand, providing markets for foreign investors to explore[21].

However, there are also some challenges that foreign investors should be noted before entering the Vietnamese market. Operating in the private education sector can be particularly competitive, requiring foreign investors to offer unique products to succeed[22]. Under Decree No. 124/2024/ND-CP, the government imposes stringent standards for international institutions partnering with local providers or establishing branch campuses in Vietnam[23]. The decree raises the investment requirements to 50 million VND per student, with a minimum of 50 billion VND for general education institutions and at least 500 billion VND for university branch campuses.

결론

Vietnam’s education development targets to 2030 highlight the country’s commitment to improving access, quality, and relevance of education at all levels. These ambitious goals present substantial opportunities for foreign investors, particularly in areas such as international education, vocational training, and EdTech solutions. However, to succeed in this dynamic market, investors must navigate regulatory complexities, understand cultural nuances, and align their offerings with local needs.

[1] TVPL. Law No. 43/2019/QH14 – Education Law <평가하다>

[2] Ministry of Education and Training (MOE). Highlights in Primary Education for the 2023–2024 Academic Year <평가하다>

[3] GSO. Socio-economic situation in the fourth quarter and 2024 <평가하다>

[4] GSO. Statistical yearbook 2023 <평가하다>

[5] GSO. Socio-economic situation in the fourth quarter and 2024 <평가하다>

[6] MOE. Summary of the 2023-2024 school year for secondary education and continuing education <평가하다>

[7] Vneconomy. 11 Vietnamese universities recognized as meeting international standards in 2024 <평가하다>

[8] VIR. Notable dealmaking points to breakthroughs in education <평가하다>

[9] GSO. Statistical yearbook 2023 <평가하다>

[10] GSO. Statistical yearbook 2023 <평가하다>

[11] VIR. Notable dealmaking points to breakthroughs in education <평가하다>

[12] Investment News. EQuest successfully raises 120 million USD from KKR fund <평가하다>

[13] VIR. Notable dealmaking points to breakthroughs in education <평가하다>

[14] Thanhnien. Nutifood ventures into education, investing in Anne Hill International School <평가하다>

[15] VIR. Vuihoc invests in The IELTS Workshop to capitalise on Vietnam’s test preparation market <평가하다>

[16] TVPL. Resolution No. 35/NQ-CP on Enhancing the Mobilization of Social Resources for Investment in Education and Training Development in the Period 2019–2025 <평가하다>

[17] TVPL. Decree No. 86/2018/ND-CP on Foreign Cooperation and Investment in the Field of Education <평가하다>

[18] TVPL. Decree No. 124/2024/NĐ-CP Amending and Supplementing Certain Provisions of Decree No. 86/2018/NĐ-CP Dated June 6, 2018, of the Government on Regulations for Foreign Cooperation and Investment in the Field of Education <평가하다>

[19] VIR. Notable dealmaking points to breakthroughs in education <평가하다>

[20] Vietnam Briefing. Vietnam’s School Education Sector: Foreign Investment Scope and New Regulatory Changes <평가하다>

[21] Vietnamplus. Vietnam wants high-quality human resources training in STEM <평가하다>

[22] Saigon Economy. M&A in Education: Finding Sustainable Structures in Finance and Training Quality <평가하다>

[23] TVPL. Decree No. 124/2024/NĐ-CP Amending and Supplementing Certain Provisions of Decree No. 86/2018/NĐ-CP Dated June 6, 2018, of the Government on Regulations for Foreign Cooperation and Investment in the Field of Education <평가하다>

| 주식회사 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. [email protected] + (84) 28 3910 3913 |

다른 기사를 읽어보세요