날짜:

에 의해: B&Company Vietnam

업계 리뷰 / 최신 뉴스 및 보고서

댓글: 댓글 없음.

Abstract

In Vietnam, Japanese health supplement products are quite familiar to the Vietnamese people with many brands and an increasing volume of imports each year. However, products from markets such as Singapore and the United States still dominate compared to those from other markets.

———-

General context of the Vietnamese health supplement products market

These products have been imported into Vietnam since the 2000s and have grown steadily over the years, indicating that people are increasingly concerned about and desiring to improve their health. With the rising income and improving standard of living, people have more ability to afford these products. Additionally, the aging process is happening rapidly, especially after the Covid-19 pandemic, people pay more special attention to each individual’s physical health and resistance. Meanwhile, modern lifestyles and unscientific diets cause the body to lack nutrients and need supplementation through supportive products. This growth is expected to continue to increase in the future as people increasingly recognize the supportive effects that these products bring.

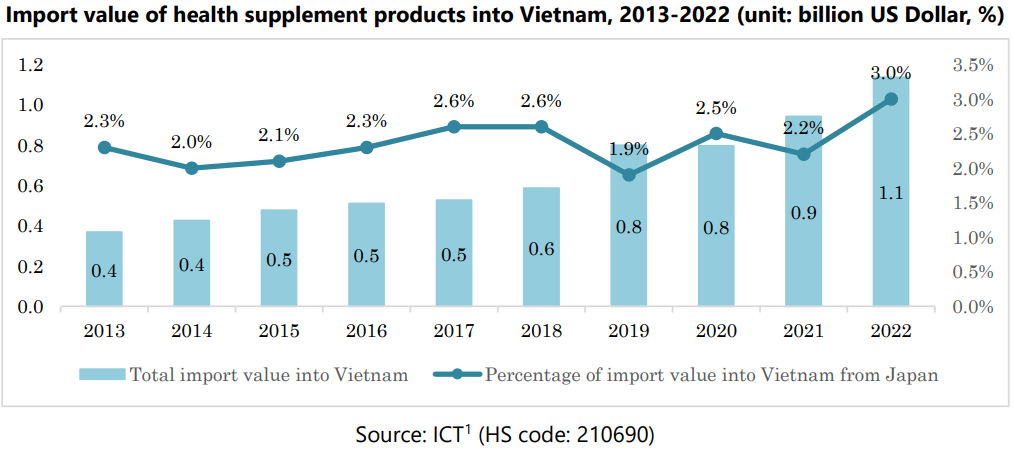

The import value of health supplement products in Vietnam

The import value is large and growing year by year, but the percentage of import value from Japan is not much. Vietnam mainly imports from Singapore (24.4%), the United States of America (22.4%), Malaysia (6.1%), China (5.4%), and Korea (4.8%), with Japan ranking 11th, accounting for 2-3% of the total import value. The import value from Japan has increased over the years from 8.4 million USD in 2013 to 33.6 million USD in 2022. However, when considering the percentage of import value From Japan, there was a sharp decline in 2019 (<2%) but then recovered and increased higher and reached a value of 3% in 2022.

Japanese health supplement products in the Vietnamese market

In Japan, products labeled as dietary supplements are not regulated and are not subject to any supervision regarding issues including production method, ingredients or concentration, as well as product appearance. In contrast to the United States, the European Union and the Association of Southeast Asia both have their own legal frameworks for this product line . Some brands from Japan are known to Vietnamese people such as DHC, Orihiro, Unimat Riken, Kobayashi, Itoh, Daiichi Sankyo.

Vietnamese consumer behavior about using health supplement products

In Vietnam, only 21% of the Vietnamese population used health supplement products in 2017 , by the end of 2022, this figure had risen to over 60%. Despite the increasingly established role of health supplement products and their wider use in daily life, consumers still have concerns about product quality. These products are currently used mainly through word of mouth and are not officially prescribed by doctors . According to a recent consumer survey by B&Company (in March, 2024), the benefits most expected by consumers when using health supplement products are Improving general health (75%), Maintaining a good appearance (18%) and Others (9%). Product selection for dietary supplements relies on recommendations from family or friends (74%), sellers (40%), pharmacists (26%), and the purchase location of these products is also through friends/acquaintances (nearly 40%) and pharmacies (30%) .

Government direction

The direction for sustainable development of the health supplement products market was also discussed in a seminar (in December, 2022) attended by the Vietnam Food Safety Authority (Ministry of Health) and the Vietnam Association of Health supplement products. In 2022, 60-80% of these products in the Vietnamese market are domestically produced . Along with the development of health supplement products, management faces certain difficulties, particularly in ensuring the quality of products sold and combating counterfeit products. In addition to penalties, in 2021 and 2022, the Vietnam Food Safety Authority issued numerous warnings on its website vfa.gov.vn, as well as on Facebook, YouTube, and e-commerce platforms. In 2021, 79 stores and 107 products in violation were processed, reviewed, and removed. In 2022, 1,145 stores in violation were processed .

Prospects for the health supplement products market

Health supplement products will continue to be a highly promising business sector in the future. However, manufacturers and businesses still face many challenges, including inconsistencies in management mechanisms, product regulations, and most importantly, building trust with consumers .

B&Company

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News. Please see below for more information

|

주식회사 비앤컴퍼니 2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. [email protected] + (84) 28 3910 3913 |

다른 기사를 읽어보세요

[/vc_column_text][/vc_column][/vc_row]